EKMH Innovators Interview Series

An interview series spotlighting global tech influencers, disruptors, visionaries, and of course, innovators.

Powered by blockchain technology, DeFiner.org is a true peer-to-peer fintech network for digital savings, loans, and payments. DeFiner’s decentralized financial (DeFi) platform enables users to effortlessly lend, borrow, and earn digital assets within a global network.

Recently accepted onto the TechStars Accelerator programme, DeFiner aims to remove the “friction and costs” associated with conventional financial services and instead offers maximum flexibility to set one’s own rates and terms. DeFiner also removes the need for third parties from its financial ecosystem, by using an immutable blockchain to track all loans and transactions, providing ultimate security for users. By providing 24/7 global accessibility with significantly lower costs than traditional finance, DeFiner allows those embracing the new, digital economy to unlock instant value from their assets.

I caught up with DeFiner Founder and CEO Jason Wu via email to learn more about his perspective on blockchain technology relationship to real-world problems, including addressing the COVID19 pandemic. Wu also eloquently addressed other topics including DeFi, blockchain architecture, the Techstars Programme, team communication, working remotely and growth plans. Our interview follows.

EKMH: How has/does the quarantine help you reconnect with your team and refocus your mission?

Jason Wu: I wouldn’t say exactly quarantine helped. What really got us to rethink our mission is Covid-19 and the issues in the economic market. The effect of the virus on the market made us realize that in order to successfully navigate out of this dark time, we need to focus on what matters the most to us. We like to call it the north star — the brightest star which remains in the same spot above the northern horizon. At DeFiner, our north star is to deliver a true peer to peer network for financial products to empower the public. Only by focusing on our strong mission can we navigate through this current crisis.

EKMH: What advice do you have for leading and maintaining a strong rapport with high-performing team members who are working remotely? What have you learned absolutely does not work?

Jason Wu: The success of working remotely depends on strong company culture. As a blockchain startup, we align our core values with the technology’s core concept. We embedded decentralization in our culture and have always operated with remote working. It’s in our team’s DNA to work efficiently even though we are not sitting next to each other.

Effective remote working starts at the top. We must lead by example. When company leaders start the practice and have a process in place, the effects trickle down into a successful experience for everyone. Creating basic team structures such as hours of availability and agreed channels of communication is crucial. Be agile and be flexible. Only by doing this can we become a fast and effective startup.

When it comes to remote working, don’t make any hasty assumptions. If you are seeing a deliverable that does not quite match your expectations, do not assume that your employee is slacking off. Again, communicate with them. Start a meaningful conversation with your team and learn what they are struggling with. Then, provide the help and directions based on your conversation. Learn to trust that your employees are capable of managing their own time and will deliver the work. During this time, communication is more important than ever. Effective communication is the key to a successful remote working experience.

EMKH: How is DeFiner.org redefining the P2P fintech network for digital savings, loans, and payments? What opportunities do you see now in the DeFi sector? Where do you see potential partnerships?

Jason Wu: DeFiner is a true peer-to-peer network for digital savings, loans, and payments. Powered by blockchain technology, DeFiner’s decentralized financial (DeFi) platform enables users to effortlessly lend, borrow, and earn digital assets within a global network. DeFiner removes the friction and costs associated with conventional financial services and instead offers maximum flexibility to set one’s own rates and terms. DeFiner also removes the need for third parties from its financial ecosystem, by using an immutable blockchain to track all loans and transactions, providing ultimate security for users. By providing 24/7 global accessibility with significantly lower costs than traditional finance, DeFiner allows those embracing the new, digital economy to unlock instant value from their assets.

The DeFi sector is full of worthwhile opportunities, especially in the current market. Thus far, none of our competitors have mastered the challenge of cross-chain compatibility. Compatibility and interconnectivity will be important for decentralized finance in the future. DeFi is most popular with the Ethereum blockchain right now, however, the largest digital asset is bitcoin. Major efforts have been made in terms of making it compatible with other blockchain assets. In terms of interconnectivity, DeFi projects are looking to easily connect with other DeFi services, clearly defined API, standard smart contracts, etc. Each DeFi project will continue to focus on its specialized area but looking to integrate and build channels with other DeFi projects will remain crucial to be able to better serve customers. DeFiner is bringing these solutions to market.

As DeFiner is aiming to build the fintech network, there are several industries that we are currently targeting for potential partnerships: Self-directed IRAs, financial API platforms, and the invoice finance ecosystem. Together with players in these industries, we aim to build a healthy and prosperous financial ecosystem. On the IRA side, we are working to launch the first DeFi self-directed IRA account. This will open the door for retirement savings to benefit from DeFi fixed income products such as collateralized loans. In the invoice industry, we are exploring the possibility of launching the first DeFi invoice-finance for SMEs. As for working with financial API platforms, we are planning to work with industry leaders on launching prepaid Visa and Mastercard cards to provide liquidity for digital assets borrowers and allow them spend fiat currency anytime they want.

EKMH: How can DeFiner.org’s DeFi streamline lending, borrowing, and earning digital assets within a global network while securing data exchange? Which problems persist when dealing with 24/7 global accessibility, transparency, control, security and real-time information?

Jason Wu: Blockchain is the underlying technology for DeFiner to settle all of the financial transactions happening within our true peer-to-peer network. The Ethereum blockchain has no centralized admin — the network is capable of syncing data globally within minutes and all synced data is immutable. Therefore, loans and savings transactions in the DeFiner network are settled and synced in minutes globally. It’s a highly secured network as there is no central admin, but thousands of admins to maintain the network globally 24/7.

Traditional financial companies usually spend billions of dollars to protect their centralized server from hacking. This is the single point of failure problem. Blockchain helps to avoid the single point failure problem as if there are thousands of servers to keep the same genuine information. More importantly, all savings and loans transactions that happen on the DeFiner network are immutable to avoid double spending and fraud issues. This is the beauty of the distributed ledger technology.

One persistent problem is that of scalability for the entirety of the DeFi industry. All companies in the blockchain and DeFi industry are building an internet for money. I call it a “finternet”, which allows for free money exchanges between people, similar to the way we can currently exchange information freely and in real time. The current stage of “finternet” is comparable to the early 90s of the internet. The capacity is somewhat limited and you can count the data transmission of “finternet” in kb. Improving the “internet” exchange of money value information from kb to GB then to TB is the persistent challenge that we all need to solve together.

EKMH: What is DeFiner’s roadmap for releasing and implementing new products and apps now and post-pandemic? in the next three years?

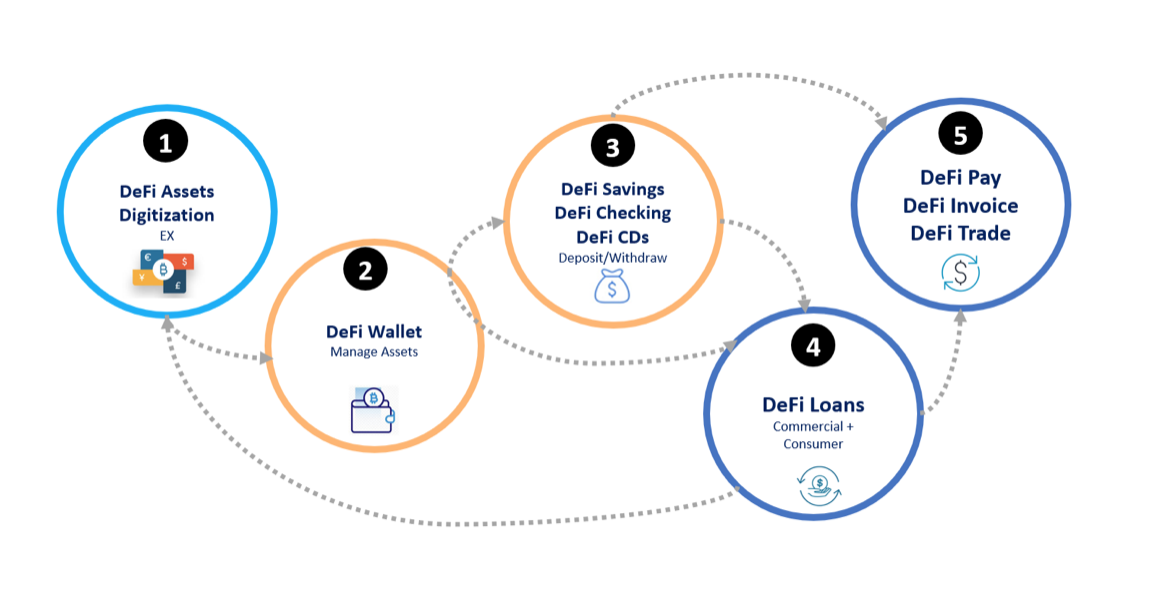

Jason Wu: We have 5 general product sections: DeFi Assets Digitization, DeFi Wallet, DeFi Earning, DeFi Loans, DeFi Payments. For each product section will have web, mobile, and desktop applications. Within DeFi Earning, there is DeFi Savings, DeFi Checking, and DeFi CDs. DeFi payment includes DeFi Pay, DeFi Invoice, DeFi Trade. In 2020, we are aiming to complete both web and mobile applications for DeFi Loans, DeFi Savings, DeFi CDs, and DeFi Wallet.

In 2020, we are aiming to complete both web and mobile applications for DeFi Loans, DeFi Savings, DeFi CDs, and DeFi Wallet. Beyond that, in 2021, we will be working to launch our web and mobile applications for DeFi Payments, DeFi Checkings, and DeFi invoice. In 2020, we hope to have all of these products also up and running with desktop applications, as well as also launching solutions for DeFi digital and Defi Trade. In short, within the next three years, we are aiming to bring to market an entire suite of decentralized financial services and products that bring together a global network for any financial purpose.

EKMH: How has Techstars helped evolve your vision and efficacy as a leader? What career advice do you have for those considering a career in blockchain and fintech?

Jason Wu: I treat Techstars as an entrepreneurial school, which taught me life-long lessons. Not only does the team learn from the program, but also we learn from other founders. The most valuable lessons we absorb from the program, which are also the Techstars mission, is to “do more faster” and “give first”. It taught us how to dream big and land on our feet. It helped me shape my vision and lay out a path for growth. A startup has to be agile. Only by doing more faster and doing more in an efficient way can we achieve start-up success.

Fintech and blockchain is a forever changing space. This is a relatively new technology and it is constantly evolving. Adaptability and student stamina are more crucial than ever. Always keep an open mind and pay attention to what is going on in the space.

The word ‘Fintech’ is self-explanatory — combining both finance and technology. You need to master the two elements in order to achieve the best of both worlds. Only understanding one side of the story will be blind spotted and opportunity will slip. In the dynamic environment of finance, newer automation technologies will mean less of a focus on task-oriented activities, and a stronger focus on problem-solving and finding ways to improve current systems.

EKMH: Finally, which books, videos and/or podcasts would you recommend to readers and why?

Jason Wu: The book I want to recommend to everyone is Venture Deals by Brad Feld and Jason Mendelson. I was given this book by our Techstars MD Vijay Tirathrai with the message of “Pitch Well. Raise Fast. Close Well.” The Venture Deals was recommended to all Techstars founders and I understand why it was widely recommended after finishing reading it. This book equips an entrepreneur with every piece of knowledge they ever need for fundraising. One of the most valuable lessons for entrepreneurs is to learn from others and trust experts and this book gives you a taste of both.

*Disclaimer: The views and opinions expressed in this series are those of the interviewees and do not necessarily reflect the views or positions of any entities they represent.

Search below and read more interviews in the Innovators Interview Archive or via MuckRack. Don’t miss an interview or prediction! Be a part of the conversation.